2020 Forecast: How the Rental Equipment Market is Shaping Up for the New Year

Another new business cycle is upon us. Overall, 2019 was kind to the tire technology and commercial equipment industries. The past calendar year brought continued success and growth to the Off-the-Road (OTR) and heavy vehicle rental markets. As those fields remained healthy, in turn, the tire fill space (commonly referred to as foam fill) continued to thrive to keep pace with the industry. So, what’s on the horizon in terms of market forecasts for the coming year?

According to a recent report by MarketsandMarkets.com (a leading B2B research firm), the global construction equipment rental market can expect ongoing growth through the year 2024. In the research firm’s end of 2019 “Construction Equipment Rental Market by Equipment, Product and Region” Global Forecast, the industry currently generates $98.6 billion in business (in U.S. dollars) and is expected to reach $121.6 billion USD by the year 2024—a compound annual growth rate (CAGR) of 4.3 percent from 2019 to 2024. The study focused on earthmoving, material handling, road building and concrete equipment and specific products such as backhoes, excavators, loaders, crawler dozers, cranes, compactors and concrete pumps.

All of this equipment is essential to successful on-the-job operations—both in terms of ensuring on-time productivity, effective utilization of manpower and other resources, and budget compliance. When a key piece of equipment breaks down or malfunctions, an entire construction work site can be compromised—not to mention exposing employees to dangerous conditions and putting basic safety measures at risk.

Tire technology is at the very root of proper OTR vehicle operations. A piece of heavy commercial or industrial equipment is only as effective as the tires it’s riding on—and when those tires underperform, or worse yet, become prematurely flat, they can render that truck or piece of machinery, or even an entire fleet depending on the coordinated application between multiple pieces of equipment, entirely useless.

According to the Markets and Markets evaluation, “the earthmoving segment is projected to drive the market for construction equipment rental market during the forecast period.” This is in large part due to what the industry anticipates will be a heightened level of infrastructure-related construction. This type of work typically involves the development of new roads, highways, airports and other wide-scale commercial projects. And excavators are the true workhorses for site project managers working in the infrastructure field.

As construction demands grow, the essential need for a 100% reliable tire flatproofing solution—to help keep this integral equipment running at full speed—will be more critical than ever.

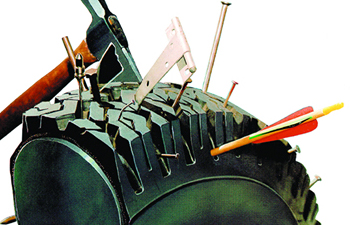

Ensuring the right solutions are in place all comes down to making a correct selection among the various tire solution options. There are two common ways that tire technology can quickly become ineffective or cause safety issues on the job: 1) pneumatic tires, although they offer an air like ride that is comfortable for drivers, can easily puncture, especially when rolling over typical job site debris such as sharp rocks, glass, nails, and rebar; and 2) solid tires, though sturdy, are cumbersome to operate, deliver an extremely rough and bumpy ride, and are prone to cracking under certain conditions. According to For Construction Pros magazine, solid tires “due to their stiffness and lack of flexibility, can more readily tear up soil and lose traction in muddy conditions. The thick rubber, while impenetrable, also provides the least comfortable ride and adds a considerable amount of weight.” Both of the above choices can have a potential negative impact on construction site productivity.

But filled pneumatics offer the best of both worlds and are well poised to handle the rigors of a growing construction marketplace. Tires using “foam” fill technology (an injectable polyurethane which can be pumped into any pneumatic tire to replace air with a resilient, synthetic elastomer core) completely eliminate dangerous and costly tire flats in commercial and industrial heavy equipment vehicles. Brands like Carlisle TyrFil, which has been a pioneer in the industry for the past 50 years, have become synonymous with cost efficiency and reliability, and have helped to establish a gold standard within the tire fill industry that construction operators can rely upon, especially as work volume increases.

Analysts expect the North American market to be the prominent growth focal point during the coming four years, as it also represents the largest construction equipment rental market. Based on these assessments, 2020 is looking to hold its own in terms of growth and present good upside for OTR tire dealers and technology providers, which must work in tandem with the rental equipment space.

When it comes to overall construction, certain variables mandate a “wait and see” stance with regard to the exact growth map throughout the New Year. For one, it’s Election season. Regardless of political persuasion, most American businesses can likely agree on one thing: Presidential Election years bring a relative amount of uncertainty to the marketplace. How will job growth, economic spending policies, new trade agreement, regulatory changes and the like affect construction industry projections? As noted in Construction Dive, industry will simply have to collectively watch and monitor for specific growth estimates.

Additionally, the market will likely see flutters from labor force fluctuations. As unemployment has plummeted, which is extremely positive for the nation and for industry growth overall, there are less skilled workers (including drivers of OTR equipment) available. This plays a role in how aggressively construction operators expand their equipment and heavy transportation vehicle line-up.

But that shouldn’t detract from a positive outlook for the OTR space in particular. According to the Association of General Contractors (AGC)/The Construction Association, “…most construction firms expect demand for their services and hiring will expand in 2020.”

And in general, the tire technology and road care industry can certainly look forward to reaping the benefits of the New Year ahead. As stated in the Markets and Markets report, “the construction equipment rental industry in North America and Europe, along with the preference toward rental for construction rather than purchase, is expected to fuel the growth of the market during the forecast period.”

For more information, please reach out to a TyrFil representative to learn more about our flatproofing technology and how it can help your own business grow in 2020.

The Carlisle TyrFil Team